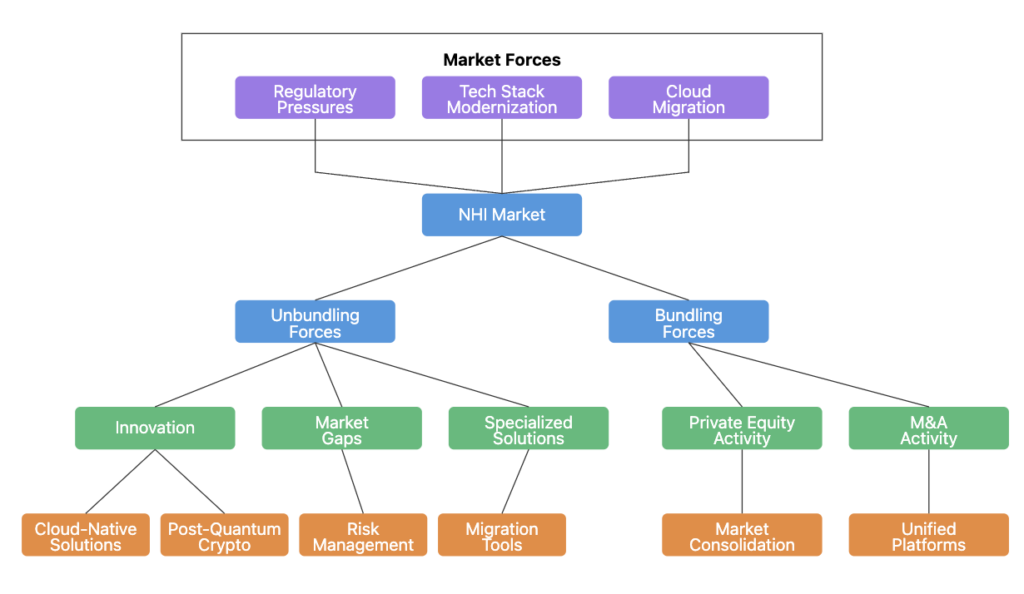

Jim Barksdale famously said “All money is made through bundling and unbundling,” and this dynamic is evident in the Non-Human Identity (NHI) market. Cryptography management, privileged access management, and certificate lifecycle solutions are being redefined under a higher-level taxonomy. These functions, once viewed as isolated, are increasingly integrated into broader frameworks addressing identity, governance, and security holistically, reflecting the market’s shift toward unified and specialized solutions.

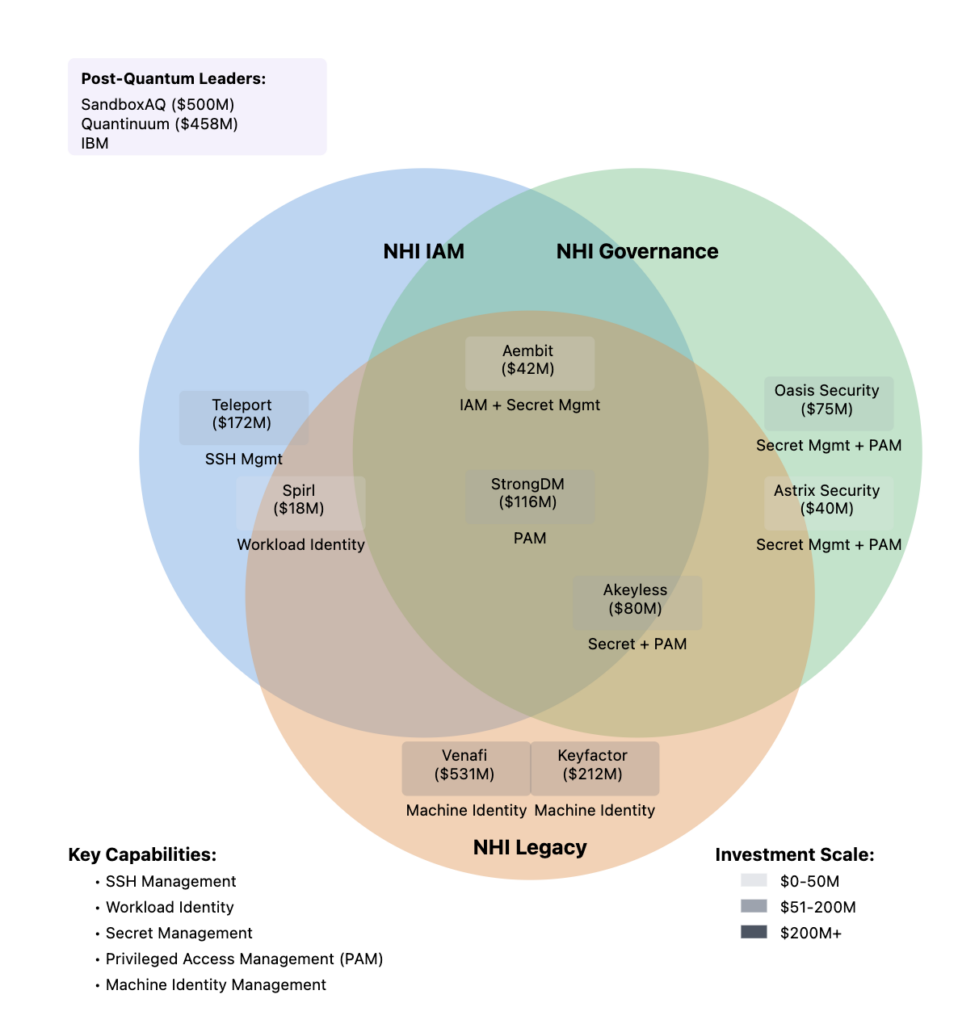

Cloud providers dominate in offering integrated solutions across categories, but these are often limited and focus on cost-recovery pricing to encourage adoption of their real money-makers like compute, storage, network, databases, and these days AI. They frequently provide just enough to facilitate a single project’s adoption, leaving opportunities for other vendors. For instance, Microsoft’s push to migrate enterprises from on-premises Active Directory to its cloud offering presents an opportunity to unbundle within the NHI IAM space. By focusing narrowly on migrating existing infrastructures rather than reimagining solutions from first principles to meet modern usage patterns, Microsoft has created gaps that smaller, more agile providers can exploit. Similarly, regulatory pressures and the rise of AI-driven, agentic workloads are driving demand for advanced workload authentication, creating further opportunities for specialized providers to deliver tailored solutions. Meanwhile, established players like CyberArk and Keyfactor have pursued acquisitions, such as Keyfactor’s merger with PrimeKey, to bundle new capabilities and remain competitive. However, the integration complexity of these acquisitions often leaves room for focused providers to address modern, cloud-native demands more effectively.

At the same time, traditional cryptography management companies have been so focused on their existing Key Management System (KMS) and Hardware Security Module (HSM) offerings that they have largely ignored broader unmet needs in the market, prioritizing feature expansion and acquisitions aimed at chasing smaller competitors. This narrow focus has left significant gaps in visibility, particularly around cryptographic assets and risks, creating fertile ground for new solutions focused on cryptography discovery, automated inventory management, and preparation for post-quantum cryptography.

Capital allocation, on the other hand, highlights category focus and growth potential. Seed and Series A investments underscore the dynamic opportunities created by unbundling, as well as the constraints faced by larger vendors burdened with legacy products that make it harder to truly innovate due to existing commercial obligations in the same space. In contrast, private equity activity targets larger bundling opportunities, enabling less agile and more mature market leaders to remain relevant by scaling established solutions or consolidating fragmented players. These stages illustrate the market’s balance between early-stage innovation and late-stage consolidation, driven by the growing demand for unified, cloud-native identity and governance solutions.

These patterns of bundling and unbundling are organic and continual, offering just one lens on the evolving dynamics of this market. While the NHI market appears new, it is, in fact, a natural evolution of existing identity governance patterns, driven by the growing demand for unified, cloud-native identity and governance solutions. This evolution underscores the balance between early-stage innovation and late-stage consolidation, as new entrants and established players alike navigate the opportunities created by shifting market dynamics.