The first web-server was developed by CERN in 1990 — that is twenty-four years ago!

Back then the web was a much simpler place. For the most part web pages were static files hosted by a single server owned and operated by the same entity that managed core network infrastructure, and DNS. In many cases they even owned the building where the systems were located.

As the web became more popular the architecture of these systems needed to evolve. At first that was done by bolting on basic search capabilities. The database-backing search was simply another process running in background indexing the documents.

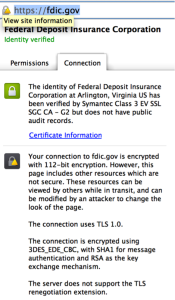

Around 1994 SSL came about. It was used almost exclusively in e-commerce scenarios.

These systems e-commerce systems were really the beginning of the complex n-tier deployments we have today. With that said they were still very simple by today’s standards. These new systems were essentially made up of a cluster of web servers sitting in front of a shared database one-network port away.

The processes of getting a SSL certificate back then was also quite onerous even when compared to what we do for Extended Validation today. To get a certificate in many cases you had to actually visit a public notary with documentation that proved your affiliation with the business you were getting a certificate for; the notary would then attest that they saw the originals of your identification as well as those documents. I even know of cases where company’s executive staff were required to visit the CA in person.

This complexity was because businesses identity was inherently part of what that certificate was about. As a consumer if you were dealing with a online business you knew they had a clue about technology (relatively) and because this online presence was an extension of their brick-and-mortar business you already knew — they were a known quantity and knowing it was them gave you confidence they would be applying the same diligence and practices from their online business to their online transactions.

At this point the certificates used in SSL cost as much as $1,500 each and while this slowed the adoption of SSL it also gave a signal to visitors of that the that sites that had them were not some fly-by-night operation as they were willing to spend “real” money to ensure people knew who they were.

Above and beyond that when users saw the “SSL” lock users knew their users their sessions were encrypted end-to-end and as a result their data was not going to be stolen in transit.

Given the kinds of organizations that would operate these sites (at the time this was banks and large e-commerce businesses) there was also an element of “these guys get security” – after all they knew how to do all of the above and had their existing brick-and-mortar reputations they were building on.

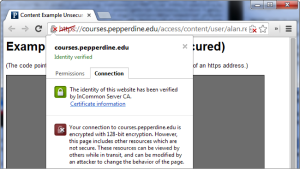

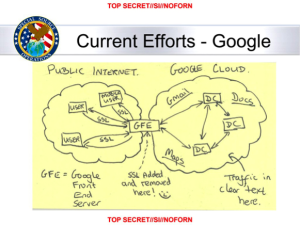

Over the next decade those small server clusters that ran these websites became more and more complicated. For these site to scale what used to run on one or two boxes got moved across many. At the edge dedicated systems were used to terminate SSL and forward clear text to back-end systems that were sometimes owned and operated by different entities and often spanned multiple networks.

The mega-sites like those run by Google and Microsoft still are designed in this way because it is the only way to cost effectively scale and be agile enough to meet market needs for systems of this size.

For the rest of the Internet this model just isn’t used that much anymore – its just not cost effective for small sites and most organizations don’t have access to the skills or resources to deploy the kind of networks and systems that these larger sites do. For this reason most sites have moved from deploying onto hardware and networks they own to those owned and operated by other people.

It is now the norm and not the exception to have numerous service providers embedded in a single website, the physical hardware being used by these the site and the service providers are almost always multi-tenant, even the databases backing a them are likely shared.

Expectations of users about how the web performs has changed as well, for this reason an entire industry developed to provide yet another shared service — high-end networking services that logically sit in front of these machines to ensure timely delivery wherever the user is at (AKA CDNs).

To keep pace with the demand for SSL the way certificates were priced and are validated changed as well. Today around 70% of all SSL certificates are Domain Validated (DV) and in many cases they can be had for free.

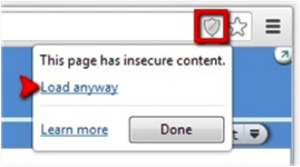

For entrepreneurs this means they can build an online business more quickly and cost-effectively than ever before. For users it means that these online businesses are fast and more professional looking but it also makes it harder to understand the security assumption behind the operational practices of the site.

The “site” as the user sees it may literally be operated by a half dozen an entities such as the network provider, CDN, DNS, hosting provider, analytics, data providers and the site it amongst others.

You don’t know what agreements the site has with these providers, how any of the entities store your data, which they share it with, or if they attempt to use good security practices in the development and operations of the services.

These things were broadly speaking inferable in the 1990’s given how few sites were on the network and the kind of investment necessary to even get online. Today some college kid in a garage could be operating your favorite site, he is motivated not by protecting his current business but by getting to market quick enough to grow his new one.

To me this means it is more important than ever before to understand whom it is your dealing with and what their security practices are. This isn’t a change that happened over night but something that has happened slowly over the last twenty-five years.

This is why its great sites publish their security and privacy practices, even if we must take them at their word. This is why it is also important to understand whom it is you are doing business with, without this how can you make an informed decision on the credibility of their word?

In a perfect world these things would not be items to be concerned with but as my father always told me we have to see the world the way it is and not the way we want it to be if we ever want to change it.